Cheering the People, not just the Prints: A Thanksgiving Look at Markets, Households, and Holiday Spending.

Greetings, everyone. I intended to publish a post this past Wednesday; however, unforeseen circumstances arose and prevented me from doing so. This article will emphasize the importance of gratitude. Despite challenges that may arise, individuals possess numerous reasons to be thankful, regardless of external circumstances.

1. Thanksgiving in a half-lit economy.

This Thanksgiving week felt like checking the dashboard of your vehicle and realizing that half of the gauges (that should be flashing) are still dark. After checking in with the Bureau of Economic Analysis (BEA), I can confirm that we are still waiting for important data to be released, such as gross domestic product (GDP), September personal income, and personal consumption expenditures (PCE) inflation data keeps getting pushed back and rescheduled due to the holidays. For investors who live on a diet specifically comprised of macroeconomic releases, this means a lot more inference and a lot less hard evidence when we try to reconcile the macro story with market pricing.

However, we can see that markets this week did what they often do best during holiday-shortened weeks: they climbed the wall of uncertainty. As Thanksgiving approached throughout the week, we can see that the U.S. equity market edged higher, with the S&P 500 logging gains not only for the week but also for the month. However, the index’s competitors being the Dow and the Nasdaq, also moved up as investors leaned further into the idea of a Fed rate cut in December. On Friday, we also saw something interesting take place, and that was one of the most important pieces of market infrastructure briefly went dark. The CME group suffered a major outage when a cooling failure at one of its data centers halted trading on its platform for just under 11 hours. This froze futures and options across the asset classes, as the data was critical for investors. In the bond market, we saw that the 10-year Treasury yield trended downward towards 4%, which had not been seen for several weeks, as the “soft landing” (that many economists are predicting) narrative is gaining traction.

From a purely market perspective, it would be easy to frame this as a simple “risk-on” holiday story: falling yields, rising stocks, and another year where Thanksgiving week is kind to equity investors. However, from my chair, I have been trying to sit with a different question on my brain, and that is: what should we actually be thankful for in an environment where the data is patchy, the news is noisy, and yet consumption just delivered another record Black Friday?

2. Black Friday 2025: Record clicks, with a side of mixed feelings.

Let’s start by looking at the headline numbers. Early tallies (just preliminary, nothing final as of yet) suggest that U.S. consumers spent about $11.8 billion online on Black Friday alone. This astonishing number is up more than 9% from last year, which was $10.8 billion, and the highest, so far, on record.

Source: Black Friday Statistics

Online shopping is stealing the victory dance from the retail or “in-person” traffic, with estimates showing e-commerce sales are up around 10% year-over-year (YoY), versus low single-digit growth for in-store purchases.

Some key details that matter for this story:

AI shopping tools and recommendation engines that debuted right before Black Friday drove a huge jump in traffic to retail sites. This enabled people to quickly find deals and temptations without wasting time scrolling.

“Buy now, pay later” (BNPL) usage set fresh records, with one research report highlighting that hundreds of millions of dollars of purchases are being tied to BNPL just on Black Friday alone and showing strong growth versus last year.

Even with people spending more money this year, the average number of items per transaction appears to be lower. This serves as a reminder to me that part of the “growth” is still due to inflation in the background.

In my opinion, on paper, this seems like the kind of “resilient consumer” narrative that the markets love and enjoy dearly. Retail stocks have historically trended upward and benefited during Thanksgiving week, especially after Black Friday, and this year is shaping up to be consistent with that pattern, especially with some BNPL names posting some strong gains.

In keeping with my theme, it is essential to consider the human narrative behind these figures, a subject that introduces greater complexity. It is within this context that the theme of Thanksgiving is most appropriately placed this year.

3. The human side of “resilient” spending.

When I look at the Black Friday data, I can see three defining and overlapping realities coming into view:

Households are making the best of a tight situation due to an affordability crisis.

Many families are clearly still willing to spend, but they are doing it with more planning and more tools than years past, such as comparison sites, AI deal finders, and BNPL financing to spread out their payments. To some investors (and those in power), it may look like resilience, but in my opinion, it also looks like people are working very hard to preserve some sense of normalcy for their families for the holidays in the face of higher prices, tariffs, and lingering job insecurities around the country.

A subtle shift from “splurge” to “stretch.”

The mix of spending this year is noted by including a lot of basics, clothing, cosmetics, and household items, alongside the usual electronics and toys. Black Friday, this year, was less about impulse flat-screen TV purchases and more about trying to secure needed goods at a temporary discount. From a behavioral perspective, I see it being encouraging that people are still treating deals as a way to stretch out their financial positions rather than simply upgrading their lifestyles, just to “fit in.”

Debt is the quiet guest at the Thanksgiving table.

From my perspective, I see the growth in BNPL metrics and the continuation of high usage of credit cards being a “red flag.” It shows me that some of this so-called "resilience” is financed. The alarming volumes of BNPL transactions are on track to surpass last year’s holiday season, at a time when credit card delinquencies are at an all-time high, not just for the lower-income earners, but also across all income segments. We need to start asking ourselves, is the short-term boost to retailer revenues and GDP going to affect the long-term household balance sheet? The answer is yes.

From an investor’s vantage point, I know that there is real temptation to cheer the spending and stop there. We know that strong holiday sales mean better Q4 earnings guidance, healthier top-line growth for consumer names, and a better macro narrative that supports the current rally. However, as I stated before…. At what cost?

From a human vantage point, I find myself thankful for something different, and that is people still care enough about each other to try and show up with gifts, shared meals, and small moments of normalcy, even when the math is tight. I am also mindful that every “record” sales figure that comes across our screens may encode not just optimism, but also stress trade-offs, and future payments that have not yet come due. Ask yourself this before you buy something using BNPL financing: “Is my future self going to struggle more due to my behavior today?”

4. What am I thankful for as an investor (and as a human being)?

So what exactly does a “thankful” investment post look like in a week like this one? This is something that I have been wrestling with all week, as I knew I would have to write this article. For me, I feel as though it is less about being grateful for specific outcomes (“stocks were up, therefore, I am thankful”) and more about being grateful for time with family and friends, as quality family time is what truly matters above all else. I am also thankful for the continued clarity that this week offers to each of us, if we are willing to dive below the headlines and find them.

First, I am thankful for signals, even ones that are imperfect.

Despite the gaps in data, which are continuing to clog the markets, we can see that the market is still sending information. Falling long-term yields alongside some modest equity gains tell a story, one that is consistent with investors believing that inflation is grinding lower and lower, and that the Federal Reserve is closer to cutting rates. The story continues by showing investors enough growth risk to buy the duration rather than chasing the cyclicals. In my opinion, I feel as if that alignment matters more than any one day’s move, positive or negative.

Secondly, I am thankful for households’ creativity and restraint.

The data that we saw this week, by way of the Black Friday numbers, suggests to me that people are not simply maxing out their credit cards just as a way to chase every promotion out there. The traffic that we are seeing is spread out over more days, online channels are doing the heavy lifting, and shoppers appear more selective in nature (showing that they are underwhelmed by the deals and willing to walk away). As an analyst and investor, I do admit that I like resilient consumption. However, my human side that pays attention to behavioral patterns, I am grateful for the instances in which resilience expresses itself in ways that look like thoughtful budgeting rather than desperation.

Thirdly, I am thankful for the reminder that the consumer is not a monolith.

The news coverage and market commentary that we all see everyday, often talk about how the “consumer” is a single agent and not flexible to change. But this week’s data illustrates an uneven landscape. We can see that higher-income households are leveraging AI tools and loyalty programs to optimize their purchases, lower- and middle-income households are leaning more on BNPL and promotions to make sure that their ends are being met. From an investment perspective, that means we should be careful about which companies we call “winners” and ask whom they are actually serving.

Finally, I am thankful for the pause that the holidays still create for us.

We know that financial markets are never fully switched off for investors, but Thanksgiving does force a slower tape for U.S.-based investors. For at least a couple of days, the “main data releases” that took place are things like how many chairs are squeezed around the dinner table, who made it home, and whether the conversation stayed mostly kind and not focused on politics or the stock market. This space makes it easier to remember that every line item, whether it be retail spending, delinquencies, or unemployment, overlaps with real lives, and we must remember that and not lose sight of it.

5. Black Friday, in context.

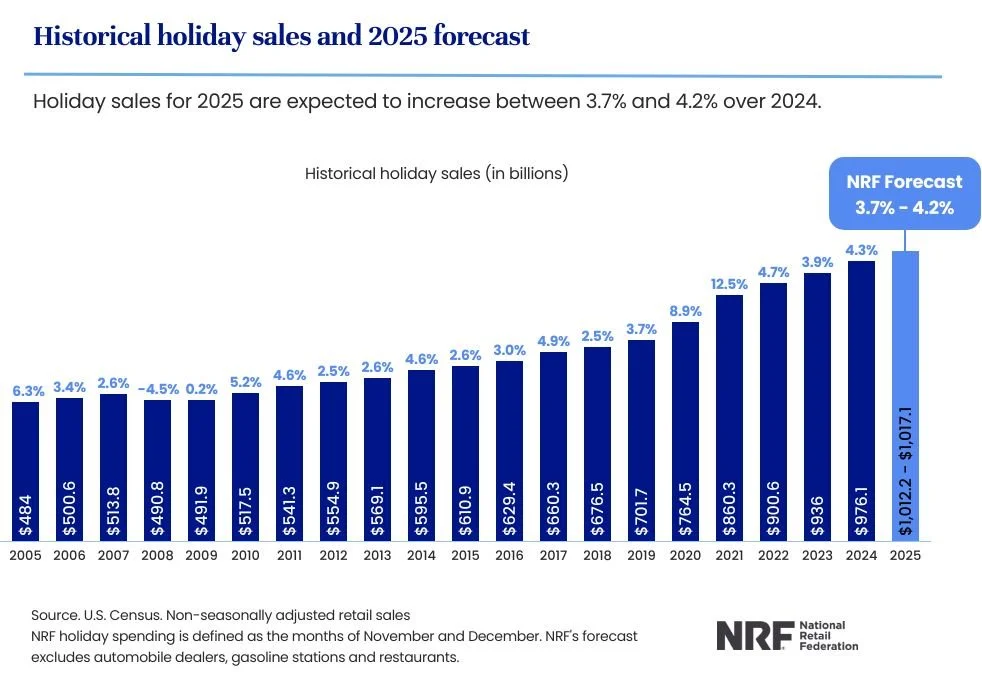

Looking ahead and also analyzing the entire holiday season, from November to December, some forecasters are expecting that the 2025 holiday season will clear the $1 trillion hurdle for the first time in history, albeit with slower growth than last year. On Monday next week, Cyber Monday, it is expected that it will be an even larger online shopping spree than Black Friday, especially for electronics shopping.

In my opinion, this means for the economy:

Short-term support for Q4 GDP and corporate earnings, especially in areas like e-commerce, logistics, and payments.

Sector divergence, as we can see that online-focused and BNPL-exposed firms are benefiting from more than traditional brick-and-mortar retail businesses.

Medium-term questions centered on how much of this spending reflects genuine disposable income versus intertemporal borrowing.

Looking at it from a behavioral perspective, the most important takeaway here is humility. When we see “record spending,” the easy reaction is to say, “Wow, things must be fine.”

Source: Tenor.com

When in reality, we need to focus on the rising delinquencies, the rising debt, and the affordability crisis that most people are currently feeling. From a neutral, objective stance, the reality is in between both scenarios, showing that millions of individual decisions, with some being prudent, some being risky, are all being made under constraints that we cannot see from a chart.

6. A closing note of gratitude.

So, in this Thanksgiving week of record online sales and incomplete macro data, here is what I am carrying with me moving forward:

I am grateful that markets still offer signals we can interpret, even if they are noisy.

I am grateful that households are finding ways to navigate this tough environment with creativity, planning, and yes, some calculated risk-taking.

I am grateful for the reminder that behind every earnings beat and sales figure that we are seeing flash across our screens is a sprawling web of humanity, their hopes, dreams, anxieties, and relationships.

I am grateful for every single one of you reading this blog and continuing to allow me to do what I love, and that is to write to a captive audience.

I am grateful for the life lessons that are currently presenting themselves to not just me, but all of you out there. Chase your dreams, no matter how big or small they may be.

As we move into December, with data that was once delayed now arriving, the Federal Reserve being on the clock for their rate decision, and the rest of the holiday season ahead, I want all of you to continue to ask yourself one simple question,

“Are we cheering the numbers, or are we cheering the people behind the numbers?"

As I continue with this blog, I hope that those who are reading this learn how to align the two together. As I close, remember to be thankful for everything that comes into your life. It is a lesson, it will test you, and you must learn from it to grow.

Sources:

Adams, R., Barnes, C., Bopst, C., & Sommer, K. (2025, November 24). A note on recent dynamics of consumer delinquency rates. FEDS Notes, Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/econres/notes/feds-notes/a-note-on-recent-dynamics-of-consumer-delinquency-rates-20251124.html#:~:text=Conclusion,increases%20may%20be%20in%20store.

Cooper, A., Banerjee, A., & Westbrook, T. (2025, November 29). Global futures reopen after exchange operator CME suffers multi-hour disruption. Reuters. https://www.reuters.com/business/cme-trading-halted-due-cooling-issue-data-centers-2025-11-28/

Edmonds, L. (2025, November 29). Black Friday shoppers are relying on Buy Now, Pay Later plans. Here’s how that could backfire. Business Insider. https://africa.businessinsider.com/retail/black-friday-shoppers-are-relying-on-buy-now-pay-later-plans-heres-how-that-could/30spvcx

Federal Reserve Bank of New York. (2025). Quarterly report on household debt and credit: 2025 Q3. https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2025Q3

National Retail Federation. (2025, November 6). NRF expects holiday sales to surpass $1 trillion for the first time in 2025. https://nrf.com/media-center/press-releases/nrf-expects-holiday-sales-to-surpass-1-trillion-for-the-first-time-in-2025

National Retail Federation. (2025, October). Winter holiday data and trends. https://nrf.com/research-insights/holiday-data-and-trends/winter-holidays

Shah, C., Cavale S. (2025, November 28). AI helps drive record $11.8 billion in Black Friday online spending. Reuters. https://www.reuters.com/business/retail-consumer/us-consumers-spent-118-billion-black-friday-says-adobe-analytics-2025-11-29/

U.S. Bureau of Labor Statistics. (2025, October). Consumer Price Index – September 2025. https://www.bls.gov/news.release/cpi.nr0.htm

Grantham-Phillips, W. (2025, November 29). Shoppers spend billions on Black Friday to snag holiday deals, despite wider economic uncertainty. Associated Press. https://apnews.com/article/black-friday-shopping-spending-7f8b8e9244171333bfa6a7e8a91bffd0